Late Payment Legislation

When we talk about Late Payment Legislation what we mean is where your customers fail to pay on time or within the agreed payment terms.

The Late Payment of Commercial Debts (Interest) Act (1998) which has been strengthened over the last 20 years offers protection and remedy for businesses who struggle getting paid on time.

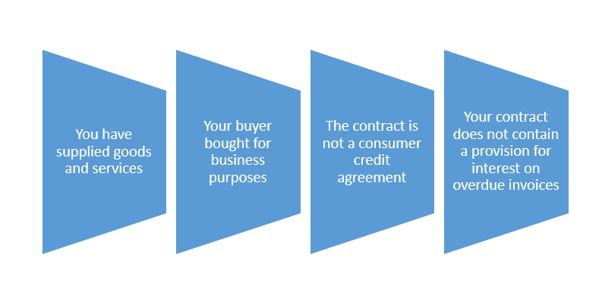

In simple terms, you can use this act if:

It’s worth noting that this act only applies where you sell to other businesses. It doesn’t cover consumers.

So to break this down in simple terms:

Where a business customer hasn’t settled an invoice with the agreed terms they can be liable for:

When we say interest, what do we mean?

Legislation allows for 8% above the Bank of England Base Rate – this needs to be calculated daily.

For example, a £100 invoice overdue for 90 days would be calculated as:

£100 x 8%(+BoE Base Rate) / 365 Days X 90 Days

When we say “fixed charges”, what do we mean?

- Debt owed up to £999.99 – £40 charge.

- Debt owed £1000 – £9,999 – £70 charge.

- Debt owed £10,000 or more – £100 charge.

These charges as per invoice (not per balance)

When we say “additional costs”, what do we mean?

After 16th March 2013 Suppliers can also claim compensation for reasonable costs in recovering the incurred debt under the late payment of commercial contracts 2013. This tends to be debt collection fees.

FAQ

Do you have you apply interest, fixed charges and additional costs?

No, you can decide which clause to apply and when. You are not obligated to use the Act on every customer.

Do we have to inform our customers that we have the right to charge them?

The quick answer is no. These is a statutory piece of legislation that applies regardless and cannot be excluded by T&C’s.

However, you will need to write to them if you actually charge the interest and/or fixed charges and it’s worth noting that the threat of the Act can be a collection tool.

It’s also worth noting:

- Businesses (or their receivers or liquidators) have 6 years in which to make a claim.

- You can still claim after the invoice has been paid.

- If the purchaser disputes the original invoice or the interest the matter may be taken by either party to the County Court.

- The supplier can also sell or transfer the debt to a third party, though the supplier should inform the purchaser in writing that the debt has been transferred.

- You do not have to exercise the right to claim interest under the Act and can accept part-payment or staged-payment.

So what is “Late Payment”?

A late payment is defined as where the agreed credit period given by the supplier to the purchaser has expired.

If no credit period has been specified by the supplier, the Act specifies a default period of 30 days after which interest will accumulate

What does this mean in practice?

Unless the values are significant, most businesses don’t charge interest unless going through court because:

- Cumbersome to manage

- Changes constantly

- Values tend to be small

- Little or no impact

However fixed charges are widely used, and the threat of charges can be a powerful tool when used in in payment negotiation or Credit Control.

Read our last blog on what to include in your T&C’s here.

Waters & Gate offer both commercial and consumer debt collection. The service is based on a no win, no fee policy.

For free advice on any of the issues raised in this article please call Waters & Gate the credit management and debt recovery specialists, 029 2126 2130.