Why don’t customers pay?

Why don’t customers pay?

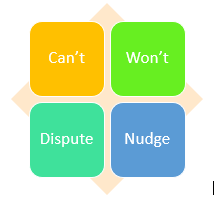

In practice, there are 4 main reasons why customers end not paying their debt on time – and more importantly some you can deal with, some you can’t.

1) Can’t

Those customers who regardless of what you can do, simply can’t pay.

There isn’t a lot you can do about the customers who can’t pay – These are the customers who you shouldn’t have sold to, that your business should have avoided at all costs.

These are the customers who simply can’t afford to pay and despite your best attempts, even the most skilled Credit Controllers can’t get blood out of a stone!

Whether using threats, legal action or debt collection agencies, the result is the same – A lot of effort for little return.

These are the customers who we hopefully spot are in trouble and don’t sell to them in the first place. We’ve created a guide to spotting customers in trouble which you can read here.

2) Won’t

The customers who can afford to pay, but don’t want to!

These customers require strict and strong action. You need to push and push hard.

They hope you give up or give in. Don’t let these customers force you into letting go. You are in the right and deserve the money.

3) Dispute

But in reality we are talking about delaying tactics – Copy invoices, spurious queries, these customers try every trick in the book to get a discount or delay payment.

4) Nudge

These are the customers who you need to press for payment, the ones that don’t pay unless pushed, nudged, chased!

So, how do we tackle these? We do this by using influencing factors – what influences our customers to pay?

Turn off supplies / service

Whether this is cancelling a contract, withdrawing terms or simply refusing to supply your customer, this can be an effective and quick way of focusing your customers mind.

Pressure

That’s you! Credit Control calling, emailing, letters etc. Constantly applying pressure to the customer to resolve the matter.

Goodwill

Those are the customers you know well, have dealt with for years. They have a strong relationship with you or the business.

Terms & conditions

Highlighting obligations and penalties in the contract can highlight the consequences of non-payment to your customer. Read our guide to what should be in your terms and conditions here.

Query resolve

Resolving their issues whether it’s a complaint or simply a change of address can go a long way to ensuring payments are prompt.

Late payment penalties

Late Payment of Commercial Debts (Interest) Act 1998 is good leverage also and allows extra protection for your business. Take a look at the legislation here and also read our guide which is in layman’s terms on the legislation here

![]()

Legal action & Debt collection agencies

Often the threat of legal action can ensure your customer knows this matter isn’t going away. If they’re still refusing to pay, we offer a no collection, no fee service so you there’s no risk to you if we don’t collect the debt.

Insolvency

A drastic measure but when you have exhausted all other attempts to resolve this may be last throw of the dice.

Waters & Gate offer both commercial and consumer debt collection. The service is based on a no win, no fee policy.

For free advice on any of the issues raised in this article please call Waters & Gate the credit management and debt recovery specialists, 029 2126 2130.